Disability Insurance Awareness Month: Why Is Disability Insurance Important?

NOTE: In May, Allsup is posting a series of blogs on Disability Insurance Awareness Month, a time when organizations join together to raise awareness about protecting your income following a disability. This series will take you through common questions about disability insurance.

No one expects to experience a disability. Many of us like to think we are invincible. We want to believe we are in complete control of our lives, at least to a certain degree.

Perhaps that’s why so few people have a solid chunk of money set aside for emergencies. According to a Federal Reserve report, 4 in 10 adults cannot afford a surprise $400 expense.

So what’s the connection? Disability often is a surprise.

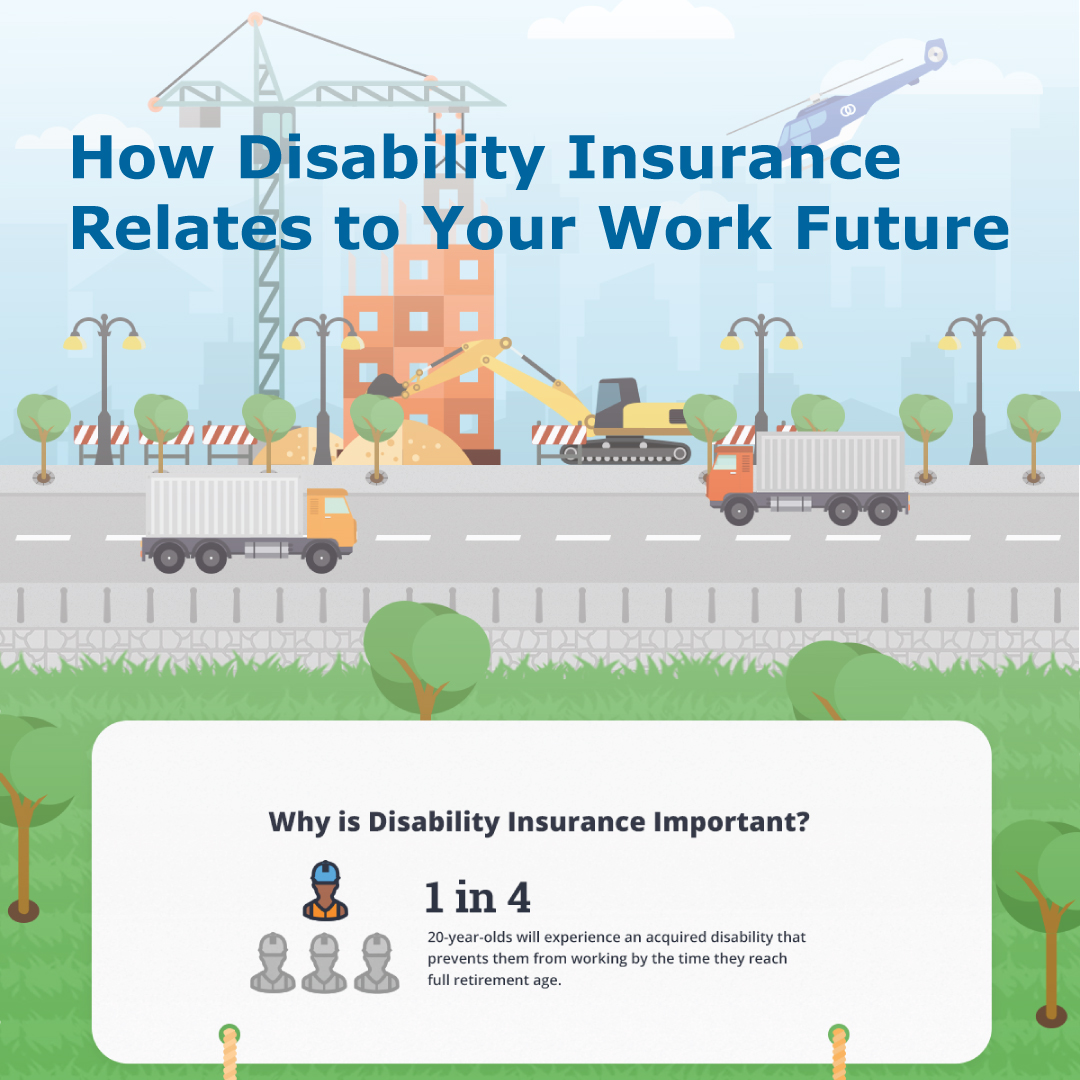

The Social Security Administration (SSA) estimates that 1 in 4 of today’s 20-year-olds will experience an acquired disability before they turn 67. Disability can be visible or invisible. Millions of Americans have unseen and debilitating chronic physical and mental conditions, including post-traumatic stress disorder (PTSD), traumatic brain injury (TBI), mental illness, diabetes, cancer, lupus, Crohn's disease and fibromyalgia.

Sometimes a health condition can happen quite quickly, with symptoms that worsen suddenly. As people lose their ability to work, they lose their working identity, and very important regular income. Therefore, having some form of disability insurance is critical.

Disability insurance may include private or employer plans, as well as the federal Social Security Disability Insurance (SSDI) program. All Americans who have paid FICA payroll taxes for five out of the last 10 years, with a certain level of earnings, are eligible to file an SSDI claim for benefits, if needed.

There are two important advantages with SSDI: regular monthly income and free help returning to work, if you medically recover. This work assistance is provided through Ticket to Work, which is a program that connects SSDI recipients with Employment Networks (ENs), while also protecting SSDI.

Not every worker will suffer a debilitating, work-limiting disability. But for the millions who do—it’s vital to understand the important value of SSDI. When and if you need it, remember that you earned it and paid for this insurance coverage through your work. It’s too important to forget.

Find more information about how to apply for disability benefits or returning to work with a disability at Allsup.com.

Allsup

Related Articles

Disability

Lupus Awareness Month: Making Lupus Visible

Disability

Navigating Work After Cancer: Free Cancer and Careers Events

Disability

Consistency & Community Matters: Brain Injury Awareness Month